We believe in a smarter rebalancing strategy. We do not administer an overly-simplified, calendar rebalancing approach where the entire portfolio is arbitrarily traded every month, quarter, or year. Instead, an active rebalancing process is built directly into the investment strategy being used for each portfolio, offering the following benefits:

PROVIDES HIGH OVERSIGHT

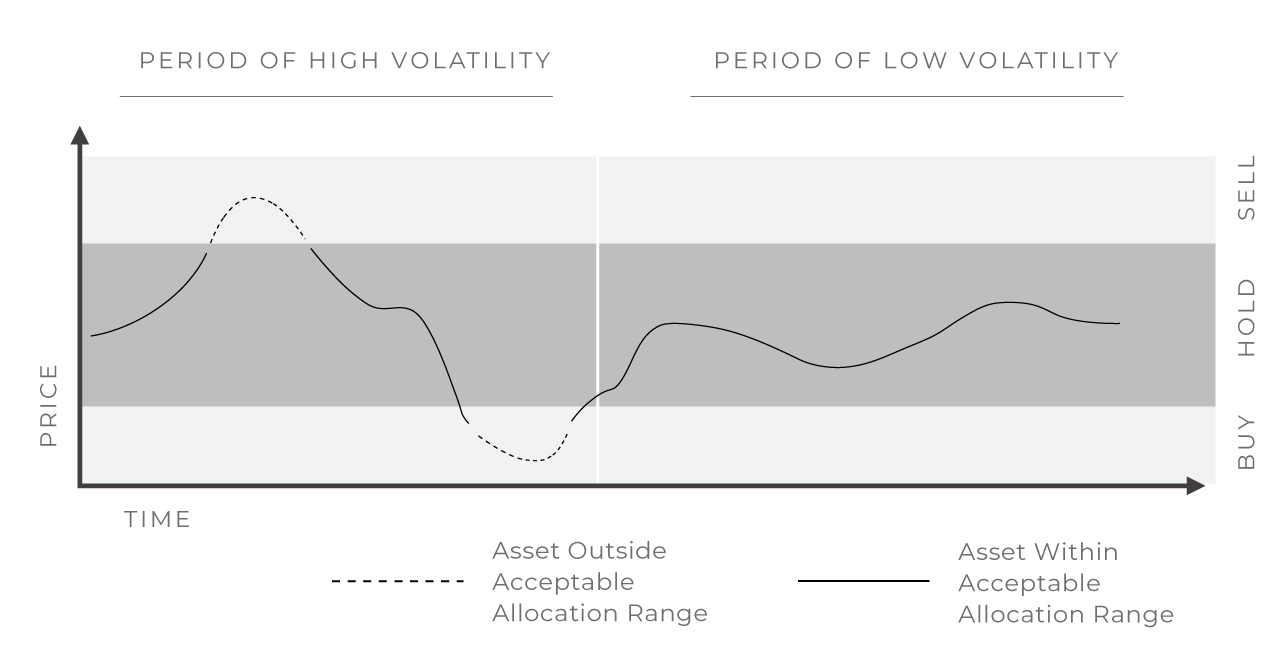

Monitors the portfolio asset allocation on a frequent and on-going basis, stiving to ensure each holding remains within it’s acceptable tolerance bond.

MINIMIZES TRADE FEES & TAXES

Maintains each holding within a custom allocation range based on the volatility of the holding, thereby minimizing the number of trades and associated trade costs.

CAPITALIZES ON MARKET MOVEMENTS

Provides a structured approach that seeks to buy low and sell high, attempting to benefit from discounted prices for purchases and elevated prices for sales.

Comments are closed.